flow through entity taxation

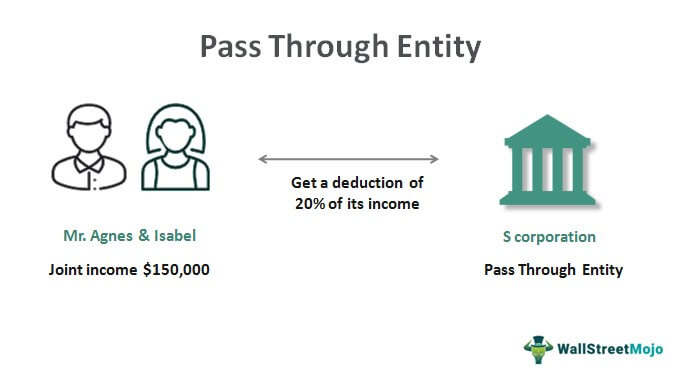

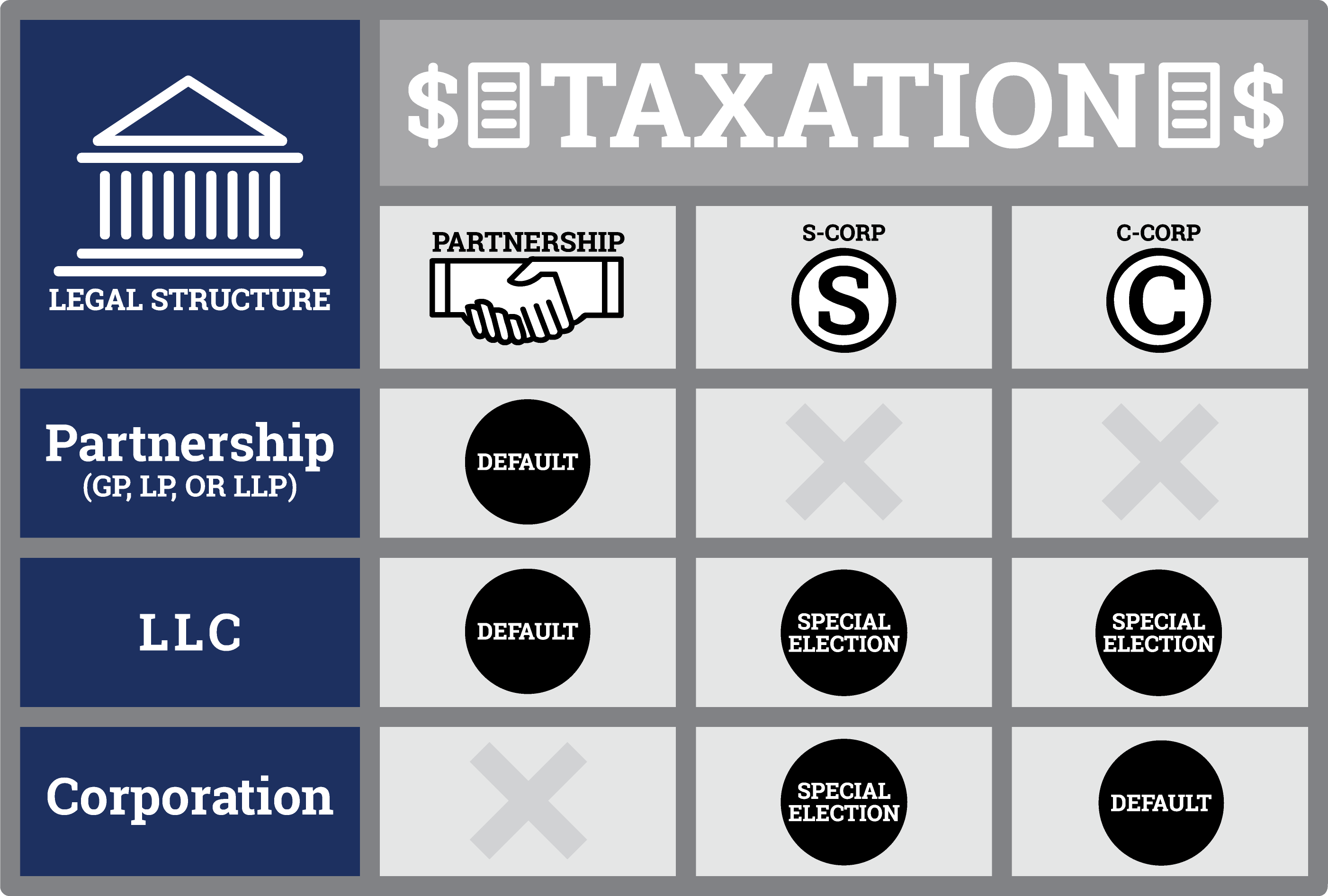

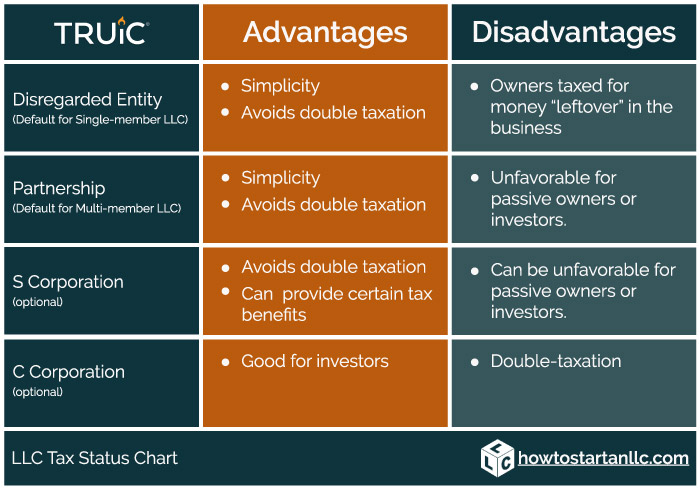

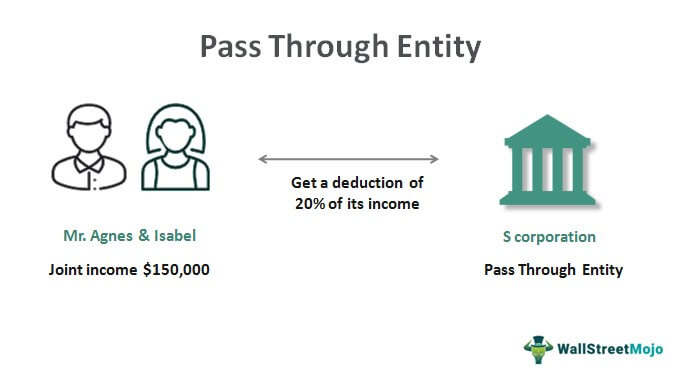

The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations. A flow-through entity is defined as an S corporation or a partnership under the internal revenue code for federal income tax purposes.

A Beginner S Guide To Pass Through Entities

In the end the purpose of flow-through entities is the same as that of.

. Log on to Michigan Treasury Online MTO to update business details authorized representative information and to file or pay tax returns. Flow-through entities are considered to be pass-through entities. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

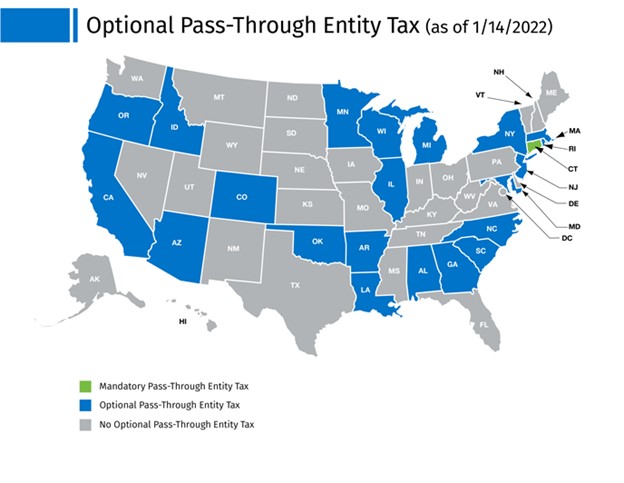

The Michigan FTE tax is levied and imposed on certain electing flow-through entities with business activity in Michigan. Any timely election for tax year 2022 is irrevocable for that tax year plus the next two successive years. A flow through entityalso known as a flow through entityis a type of business structure that avoids double taxation by having its income and losses taxed only at the member level.

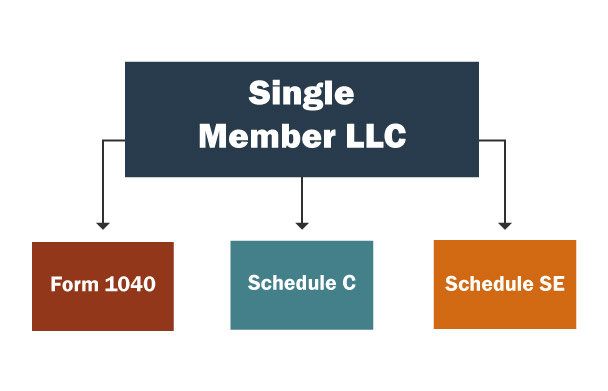

Most flow-through entities including most LLCs are subject to IRS self-employment tax 153 of your earnings according to the Motley Fool. A legitimate business entity that passes income to owners or investors of the business is a flow-Through entity. Likewise you will also need to pay state and local taxes as applicable.

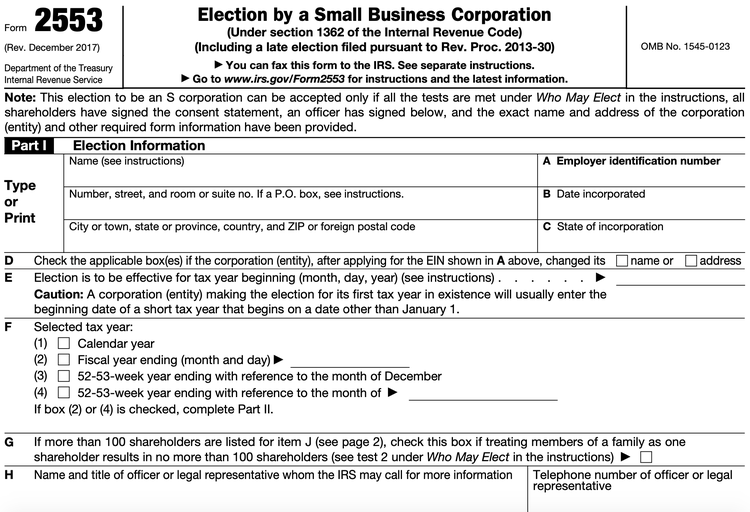

A flow-through entity is also called a pass-through entity. Additionally the election instructions inSection IB. What does a flow-through entity mean.

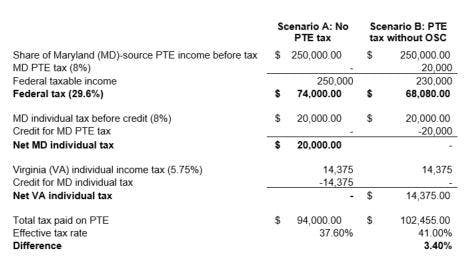

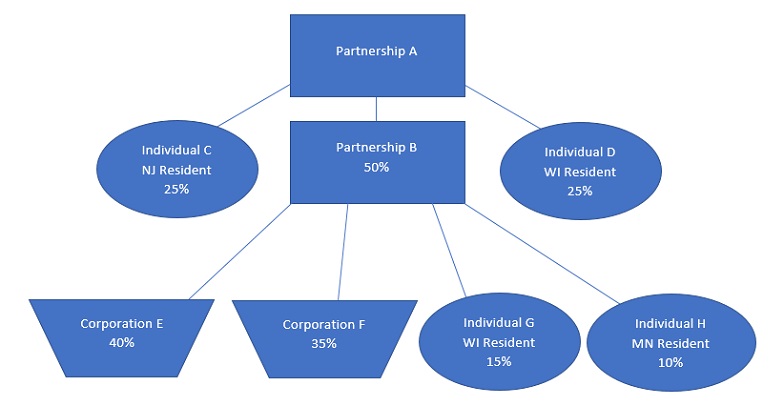

560-7-8-34 contains extremely useful guidance on a number of critical issues not merely in the area of withholding but the taxation of flow through entities generally such as the application of apportionment and allocation principles to flow through entities generally. The previous version erroneously named the due date of the annual return as the cutoff. The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here.

Date by which flow-through entity tax payments will be eligible for the credit for a particular tax year. In contrast C Corporations face double taxation. Flow-Through Entity Tax - Ask A Question.

As enacted this tax is retroactive to tax years beginning on or after January 1 2021 for flow. Flow-through entities are used for several reasons including tax advantages. Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate.

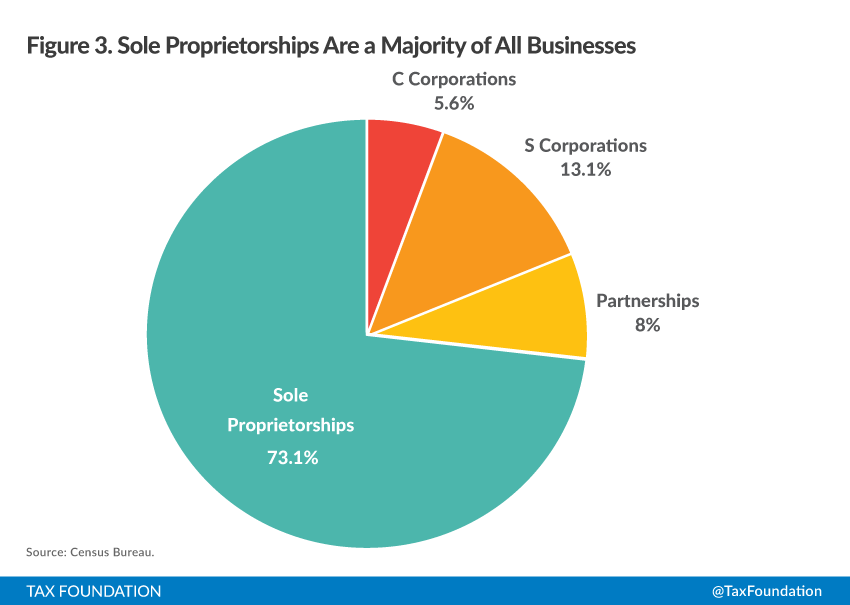

However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. Flow-Through Entity Tax - Ask A Question. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax.

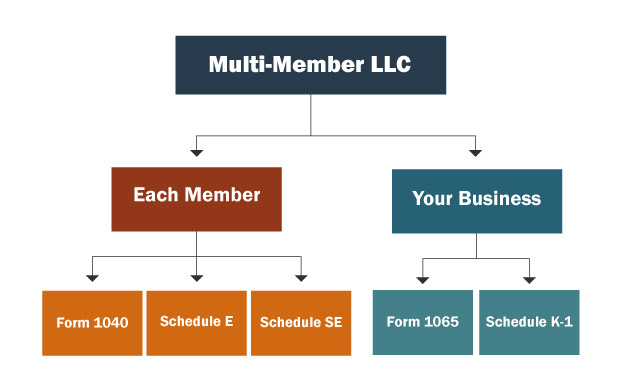

What is a Flow-Through Entity. Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. A flow-through entity does not pay federal corporate tax.

Flow-through entities are different from C corporations they are subjected to single taxation. My recent article critically analysed the range of reasons that have historically been used to justify applying entity taxation to corporations. Flow-through businesses include sole proprietorships.

The regulation which appears as Reg. Means that income is taxed only once when it flows through to the partner What are examples of unincorporated businesses. The government regards income from a flow through entity as that of the owners shareholders partners or memberstherefore the business itself isnt taxed.

That article argued that those reasons do. Have been modified to clarify the irrevocable three -year election for. According to International Bureau of Fiscal Documentation fr IBFD a pass-through entity or flow-through entity FTE is a non-taxable entity such as a partnership under which the income or expense is generally regarded as income or expense of the.

Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to claim a refundable tax credit equal to the tax previously paid on that income. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Instead the business income passes through the business to their owners and the owners pay tax for the first time on their personal tax returns.

Understanding What a Flow-Through Entity Is. For flow-through entities with calendar or fiscal tax years beginning in 2022 the flow-through entity tax election may be made through the 15 th day of the third month within the tax year March 15 2022 for calendar year filers. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital gain you reported created an exempt capital gains balance ECGB for that entity.

Elective Pass Through Entity Tax Wolters Kluwer

Pass Through Entity Tax 101 Baker Tilly

What Are The Tax Implications For An Llc Effects Of Operating As An Llc

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

What Is A Pass Through Entity Youtube

Multi Member Llc Taxes Llc Partnership Taxes

Business Entity Comparison Harbor Compliance

An Overview Of Pass Through Businesses In The United States Tax Foundation

How To Choose Your Llc Tax Status Truic

Pass Through Business Definition Taxedu Tax Foundation

Llc Taxes Single Member Llc Taxes Truic

California Enacts Changes To Elective Pass Through Entity Tax Hcvt State Local Tax Holthouse Carlin Van Trigt Llp

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Taxation What Small Business Owners Need To Know

Jp Magson Private Client Wealth Management

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Pass Through Entity Definition Examples Advantages Disadvantages